Due to rising energy prices, the German government has introduced tax relief measures. These include the 9-euro ticket and the flat-rate energy allowance.

From a payroll tax perspective, there are a few important points for employers to bear in mind.

Energy flat rate and 9-euro ticket

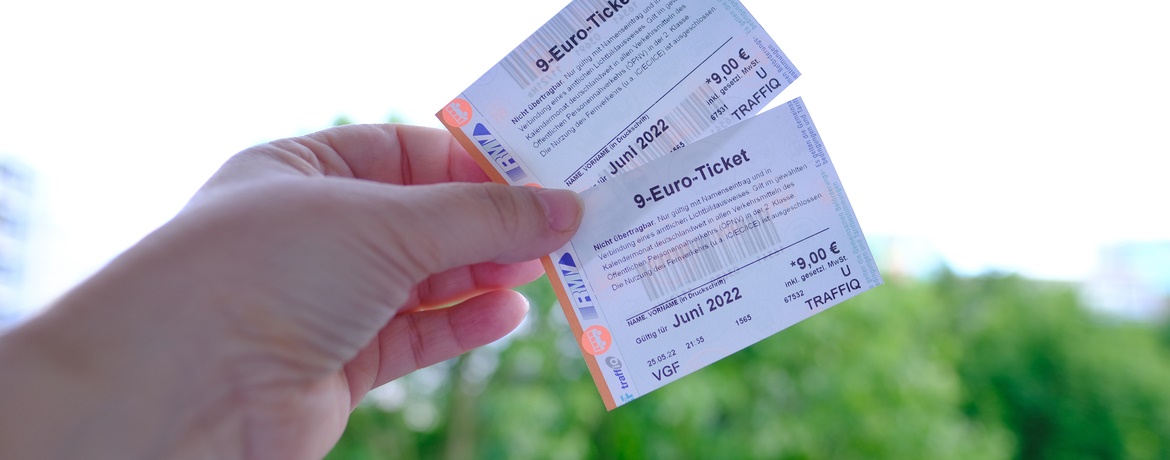

9-Euro-Ticket

In the months of June, July and August, all citizens can use public transport with the “9-EURO-Ticket”.

- Employers should adjust the amount of the subsidy for travel expenses for the job ticket to employees for the mentioned months to 9 euros.

- The amount of subsidies paid by employers to their employees must not exceed the annual actual expenses in 2022 – otherwise the excess difference must be treated as taxable wages.

Energy price lump sum

Unrestricted taxpayers who have earned income from employment in the 2022 assessment period are entitled to the energy price lump sum.

- The prerequisite for payment to employees is that they receive wages from an active first employment relationship.

- The amount of the flat-rate energy allowance will be a one-off EUR 300 per employee and is to be treated as other remuneration subject to tax and exempt from social security contributions when paid out.

- It is irrelevant whether the employee works full or part time or whether it is a type of marginally paid employment.

- The employee does not have to submit an application to his employer for the granting, but the entitlement to the flat-rate energy allowance arises automatically for all eligible employees on 01 September 2022.

Do you still have questions about these two topics?

Pia Lösch

Head of Wage and Salary Departmentt

Service phone

+49 89 547143

or by E-mail

p.loesch@acconsis.de