The requirements of the tax authorities for electronic cash registers are strict: there is an obligation to use a recording system with a certified technical security device (TSE). Electronic cash registers must also be able to issue a receipt for each business transaction. From January 1, 2025, businesses must now electronically transmit the type and number of their cash registers to the tax office.

Read moreCategory: Tax consultancy

Hamburg tax office declares ENS and TNS airdrops taxable

The Hamburg tax office has decided that airdrops of the Ethereum Name Service (ENS) and the Terra Name Service (TNS) are taxable. However, this opinion has no normative binding effect for other tax authorities. It is at the discretion of each tax authority to take its own tax position. Our article sheds light on the details and implications.

Read moreTaxes: Usufruct of a securities account reduces gift tax

When it comes to transferring assets to the next generation, there is always the issue of gift tax. If securities accounts are transferred by way of anticipated succession, a so-called usufructuary account reduces the gift tax for the person receiving the gift.

Read moreFoundation and association part 2: the charitable foundation

If you want to set up a non-profit organization (NPO), sooner or later you will have to think about the right legal form and organization. To found an NPO, you can use the common legal forms from company law (GbR, GmbH, etc.).

It is important to know here: Under certain conditions,

Read moreNew disclosure requirements for climate targets

The European Union has introduced standards for corporate sustainability reporting, including the European Sustainability Reporting Standard (ESRS) E1. This standard relates to climate protection, climate adaptation and energy.

They oblige companies to report comprehensively. It covers both positive and negative, actual and potential impacts.

Read moreObligation to notify gifts and acquisitions by reason of death

Are you aware that there is a duty of disclosure for gifts and acquisitions by reason of death in accordance with Section 30 of the Inheritance Tax and Gift Tax Act (ErbStG)?

This duty of disclosure is an essential aspect of the tax treatment of inheritances and gifts and must be made within a certain period of time.

Read moreMastering sustainability reporting with ESG technologies

Today, no company can avoid the topic of sustainability. This is due not only to pressure from investors, consumers and employees, but above all to new regulatory requirements such as the Corporate Sustainability Reporting Directive (CSRD), the EU Taxonomy and the Supply Chain Sustainability Act (LkSG). These make non-financial reporting mandatory for many organizations.

Read moreFoundation and association – Part 1: the non-profit association

Anyone thinking about getting involved in society – possibly together with others – must decide at some point what legal form this should take.

If you want to set up a non-profit organization (NPO), you can use the usual legal forms from company law (GbR, GmbH, etc.). However,

Read moreEPBD revision: EU directive drives energy efficiency and sustainability in buildings

The European Union has taken decisive steps to increase energy efficiency in buildings. In March 2024, the EU Parliament voted in favor of the recast of the Energy Performance of Buildings Directive (EPBD). The recast marks a turning point for the real estate sector. The initiative aims to reduce energy consumption and accelerate the transition to renewable energy,

Read moreE-invoicing from 2025: chore or efficiency booster?

With the introduction of mandatory e-invoicing as part of the Growth Opportunities Act passed on 22 March 2024, companies in Germany are facing a significant change. However, instead of a bureaucratic nightmare, this change also offers opportunities for increased efficiency and digital transformation. Companies should therefore not view the implementation of the legal requirements as a chore,

Read moreThe Supply Chain Act brings SMEs into the ESG reporting obligation

The German Supply Chain Act (LkSG), the European Supply Chain Act and the EU Directive on Corporate Sustainability Reporting (CSRD), together with the EU taxonomy, lead to new reporting obligations for companies in Germany and the EU.

They affect small and medium-sized enterprises (SMEs) earlier than the respective size categories of the laws would suggest,

Read moreSale of privately owned real estate

What should you bear in mind for income tax purposes when selling property as a private asset? Unfavorably chosen constellations can also have far-reaching consequences for you in the future.

In principle, the increase in value of real estate is subject to income tax at the individual personal tax rate,

Read moreGermany’s best tax consultants and auditors: ACCONSIS honoured several times

At ACCONSIS, we constantly strive to impress our clients with our in-depth expertise and outstanding advisory services. We are therefore particularly proud that our efforts have been recognised accordingly. In 2024, ACCONSIS is once again one of the consulting firms in Germany that has received multiple awards, with four prestigious seals of approval from manager magazin,

Read moreTax investigation targets online poker: When the game gets serious.

At the end of 2023, numerous online poker players who had carried out their activities on various platforms received mail from the tax investigation authorities. Some of these players were asked to complete a questionnaire regarding their poker activities. Others were immediately confronted with the opening of criminal proceedings on suspicion of tax evasion.

Read moreFrom landlord to tax evader? These are pitfalls.

Landlords beware: How to avoid unintentional mistakes on your tax return!

This article will give you an insight into how landlords can unintentionally become tax evaders. As the tax regulations in the area of letting are very complex, misunderstandings can easily arise and even well-intentioned actions can lead to serious consequences such as criminal tax proceedings.

Read moreInherited a property in Italy – and now?!

Did your parents or grandparents once fulfill their dream of owning their own property in Italy? Whether it was a vacation apartment on Lake Garda or a house in Tuscany, it is possible that this property will be included in the estate.

But what do you do with the property then?

Read moreStricter documentation requirements for transfer prices

Transfer prices, also known as transfer pricing, are an essential element of international tax planning and compliance for companies that conduct cross-border business. Transfer pricing refers to the prices charged between affiliated companies – for example, a German company headquarters and its foreign subsidiaries or branches – for goods, services,

Read moreACCONSIS honoured as “TOP tax consulting and auditing firm 2024”

The F.A.Z.-INSITUT and the renowned market research company statista rank ACCONSIS among the best tax consultants and auditors in 2024.

This award is based on a survey conducted in summer 2023, to which around 15,000 experts from tax consulting and auditing firms as well as business and corporate clients were invited.

Read moreTax-free kindergarten allowance for employees

Employers have the option of paying their employees tax-free allowances in addition to their salary for the care of their non-school-age children in kindergartens or similar facilities.

Read the following article to find out which facilities are eligible and which regulations and requirements apply.

Read moreTax evasion & voluntary disclosure – what you should know!

Many people associate the topic of tax evasion with celebrities who “end up” in prison for a certain period of time with a lot of hype in the tabloids. We remember, for example, soccer managers, ex-professional tennis players or star chefs who were tried for tax evasion, sentenced to prison and had to spend some time in jail.

Read moreFunding opportunities 2023: The innovations for energy-efficient construction and renovation for property owners at a glance

In 2023, homeowners and prospective property owners in Germany will have a wide range of opportunities to take advantage of financial incentives for energy-efficient construction and renovation. Families in particular will benefit from new KfW programs offering low-interest loans and extended credit terms. These support measures are part of a comprehensive strategy to promote sustainable real estate projects and environmental protection.

Read moreThe energy renovation of the home

When modernizing a home or changing ownership, the question arises as to what subsidy options or tax benefits are available and how they can be claimed.

Would you like to get an overview of the BEG individual measures grant, tax simplification for photovoltaic systems and new regulations for sales tax?

Read moreSustainability and ESG Strategy: Important success factors for the business handover

Due to demographic change, the topic of company succession is becoming increasingly explosive, especially in medium-sized businesses. It requires careful preparation and poses numerous challenges for both the transferor and the transferee. Moreover, a takeover process can extend over several years if legal and tax aspects are to be used optimally.

Read moreTax calculation of partial monthly amounts

An employee of your company starts or ends his employment during the current month? If so, this has wage tax implications that need to be taken into account.

In the following article, you will learn when exactly a partial wage payment period arises and what must be taken into account for wage tax purposes.

Read moreCriminal tax proceedings against crypto trader: tax office has first data available

The tax office has gained access to crypto trades – a wake-up call for all crypto traders.

- Is there now a threat of a wave of criminal tax proceedings against crypto traders?

- How do I react when the tax authorities inquire?

- What should I do if I am included on the record available to the tax office and the tax office writes to me?

Bitcoin as a commodity: Will alternative coins be classified as securities in the US?

A new wind is blowing through the crypto world, as discussions are underway in the U.S. about whether Alternative Coins (Altcoins) should be classified as securities. This potential change raises questions:

- What does this mean for fun cryptocurrencies like Dogecoin and Shiba Inu? What about established giants like Bitcoin and Ethereum?

Flat-rate payroll tax according to §37b EStG for benefits in kind

The lump-sum wage taxation according to §37b EStG offers employers the possibility to tax certain benefits in kind to employees with a uniform tax rate of 30%.

There is a choice between taxing the benefits in kind at the employee’s individual tax rate or lump-sum taxation, in which the employer bears the amount of payroll tax alone.

Read moreImportant changes in foundation law as of July 2023

From July 1, 2023, the Act on the Unification of Foundation Law will come into force, bringing together, supplementing and clarifying many previously unclear, contradictory or incomplete points in foundation law. In addition to new, uniform federal regulations, the reform also includes the introduction of a central foundation register. The changes are intended to provide greater legal certainty in matters of liability,

Read moreReal estate sale & divorce: sale of co-ownership share within holding period may be taxable

Often, a property must be sold in its entirety as part of a divorce, or one ex-spouse sells his or her co-ownership share to the other ex-spouse. The problem: if a property is sold as private assets within the so-called holding period, taxes may have to be paid on it because it may be a private sale transaction.

Read moreTax benefits for the operation of photovoltaic systems

The use of renewable energies is becoming increasingly important. To promote the expansion of photovoltaic systems, the legislature has now introduced extensive changes for operators of photovoltaic systems as part of the Annual Tax Act 2022.

Numerous bureaucratic hurdles will be removed. The new regulations will make the operation of photovoltaic systems more attractive and simpler from a tax perspective.

Read moreBitcoin & Co: BFH rules crypto profits are taxable! What do crypto investors need to know now?

With the decision of the Federal Fiscal Court (Bundesfinanzhof, BFH) of February 28, 2023, the highest German fiscal court has now for the first time taken a position on income tax issues relating to crypto assets – Bitcoins and Co.

In it, the previously issued fiscal court decisions are followed and also essential excerpts of the BMF letter of May 10,

Read morePayroll accounting 2023 – important innovations at a glance

In 2023, there are once again a number of adjustments to be made in the area of wage tax and social security law. Overview of relevant changes for employers:

- Higher earnings threshold for midijobs, minimum wage will remain

- Higher basic tax-free amount for wage tax

- Artists’

Child benefit evaded? Criminal charges for tax evasion can be the consequence!

Under certain conditions, parents in Germany are entitled to child benefit. As of January 1, 2023, the entitlement to child benefit is a uniform 250 euros per month and child and is paid out to parents by the family benefits office. So far, so good.

But if the family benefits office pays out child benefits even though parents are not (or no longer) entitled to them,

Read moreReal estate valuation newly regulated – higher inheritance tax and gift tax for real estate since 01.01.2023

Real estate valuation in the event of a gift or inheritance has always been a bone of contention. Now, the legislator has reformed the Valuation Act – and with significant effects on the calculation of inheritance tax and gift tax in connection with real estate. This is because the value of real estate has been determined on the basis of the market value for the calculation of gift and inheritance tax since the changes to the law on 01.01.2009.

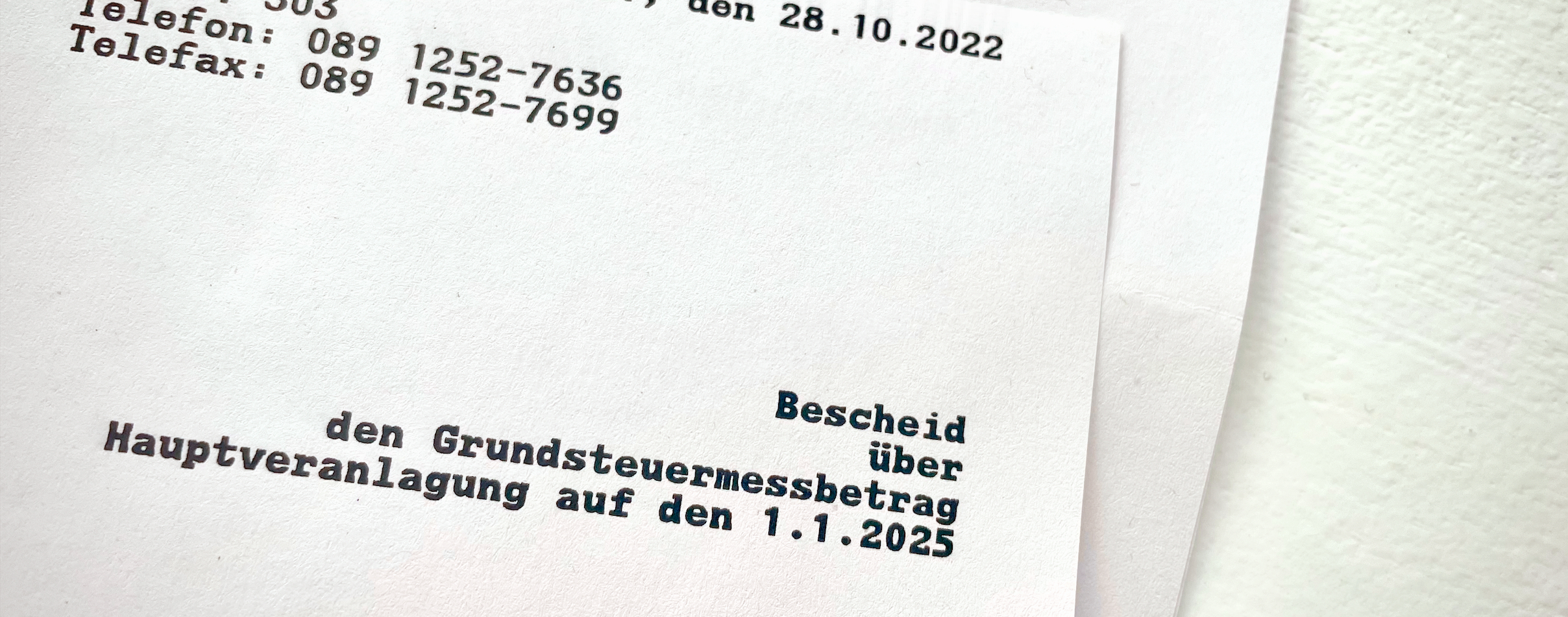

Read moreProperty tax 2022 – need for action for property owners!

Further update 31/01/2023: In Bavaria, the deadline for submitting property tax returns is extended to the end of April.

In the Free State of Bavaria, property and land owners now have a further three months to submit their property tax returns. This was decided at short notice in the cabinet on 31.1.2023.

Read moreInnovations in 2023 for sick leave and social insurance

Important changes will come into effect for employers and employees in 2023:

The paper sick bill – the famous “yellow bill” – will be abolished for those with statutory health insurance and replaced by an electronic certificate of incapacity to work. For employers, participation in the digital process will be mandatory from 2023.

Read moreCorona emergency aid – who is facing repayment?

In the first months of the Corona crisis, the government granted emergency aid to smaller companies and solo self-employed persons who found themselves in an existential emergency. Eligibility to apply for Corona emergency aid was conditional on the existence of a short-term liquidity shortage. According to the approval notice, all recipients of emergency aid are obliged to check whether the predicted liquidity bottleneck has actually occurred.

Read moreProperty tax reform: What does your notice of assessment say about the property tax assessment amount?

In connection with the property tax reform, many property owners receive the property tax assessment notices from the tax office.

In Bavaria, in addition to the “notice of the property tax assessment amount”, a “notice of the property tax equivalent amounts” is also issued.

Read moreSocial security audit and external wage tax audit – what to watch out for in the future?

As part of the irregularly scheduled external wage tax audit, checks are made to see whether employers are properly paying wage tax for their employees. During the social security audit, the German Pension Insurance checks every four years, among other things, whether social security contributions have been correctly paid.

Our experience shows: The auditors are looking ever more closely and demanding more information or evidence.

Read moreEnergetic renovation measures: How can real estate owners benefit from a tax perspective?

Since 2020, energetic renovation measures on the owner-occupied home have been eligible for tax incentives for ten years. Corresponding expenses can be deducted directly from the tax liability.

- Which measures are subsidized?

- What should be considered?

- What alternative funding options are there?

Our experts around the property give you tips and answers to 10 questions from the practice of tax incentives for energy refurbishment of your home,

Read moreInheriting debts: what you can do to prevent this from happening!

An inheritance – despite all the personal tragedy – is often a financial blessing for the heirs. Never before has so much wealth been inherited in Germany as at present. However, there is also the other case: the testator or the testatrix – e.g. one’s own parents or spouse –

Read moreThe GbR company register is coming: clarify now what needs to be done!

Information about a GbR and the persons behind the GbR has not been as easy to obtain as, for example, in the case of a GmbH.

This will change on 01.01.2024 when the Act to Modernise the Law on Partnerships (MoPeG) introduces the company register for civil law companies.

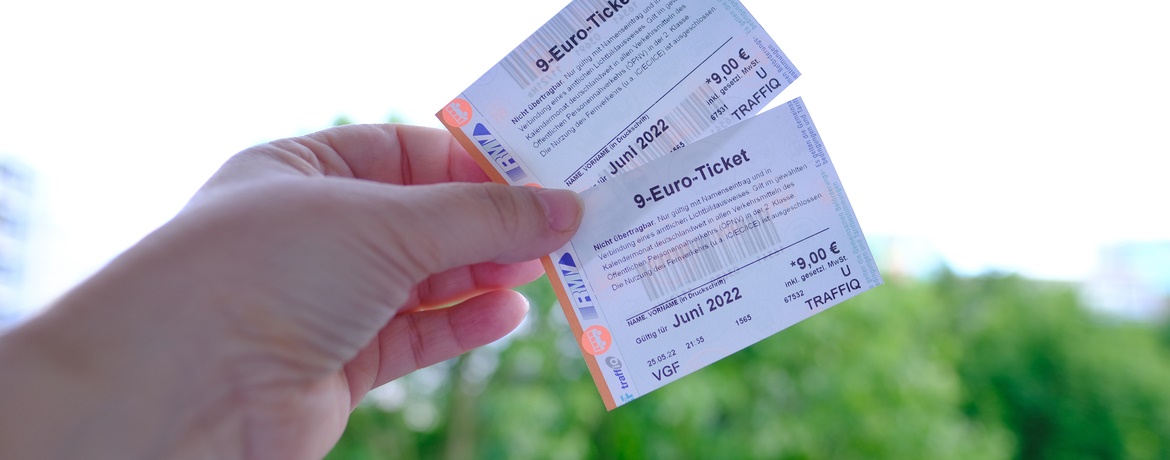

Read more9-Euro Ticket and Energy Flat Rate from a Wage Tax Perspective

Due to rising energy prices, the German government has introduced tax relief measures. These include the 9-euro ticket and the flat-rate energy allowance.

From a payroll tax perspective, there are a few important points for employers to bear in mind.

Read moreTransparency register & GmbH: Entry until 30.06. – fine threatens

GmbHs and UGs must correctly enter beneficial owners in the transparency register by June 30, 2022. Otherwise, those responsible will face heavy fines.

Read more about the transparency register and the registration deadline.

Read moreEmployment of working students – what to bear in mind

For employers as well as for students, a working student contract is an interesting thing. Employers have fewer ancillary wage costs, and students have more net left over from the gross of their salary.

To do everything right from a tax perspective, employers need to pay attention to some important issues.

Read moreCrypto, NFT, virtual currencies and other tokens: what does the current BMF letter say?

The new BMF letter “Einzelfragen zur ertragsteuerrechtlichen Behandlung von virtuellen Währungen und von sonstigen Token” has meanwhile also been published. Below you will find my brief and initial assessment of the letter of the Federal Ministry of Finance (BMF).

Our expert Dr.

Read moreIncome tax return 2021: How do I take my crypto investments into account?

With an estimated 5,000,000 people in Germany investing in the crypto world, many will soon be asking the question, “How do I account for my crypto investments in my 2021 income tax return?” Some individuals will have to make sometimes substantial tax payments as a result of their crypto investments and will thus also be required to file an income tax return in due time.

Read moreTax-free benefits in kind – increase of the exemption limit

Since January 01, 2022, the limit for tax-free benefits in kind has been raised from 44 EUR to 50 EUR per month.

The 30% flat-rate tax is not applied if the employer provides non-cash benefits to employees that do not qualify as non-cash benefits subject to payroll tax.

Read moreEnergetic renovation of the home and its financing

n principle, craftsmen’s services on properties used for one’s own residential purposes are only taken into account for tax purposes to a very limited extent.

However, if one observes important prerequisites, plans the measures accordingly and provides the necessary evidence, renovation costs can certainly be deducted from tax.

Read moreReminder! Expiry of the transitional periods for entry in the transparency register

Have you already notified the beneficial owners of your legal entity to the Transparency Register? Not yet? Then it is high time you did!

With the amendments to the Money Laundering Act (Transparency Register and Financial Information Act) that came into force on 1 August 2021,

Read more