The Hamburg tax office has decided that airdrops of the Ethereum Name Service (ENS) and the Terra Name Service (TNS) are taxable. However, this opinion has no normative binding effect for other tax authorities. It is at the discretion of each tax authority to take its own tax position. Our article sheds light on the details and implications.

Read moreCategory: Legal advice

Federal Labor Court provides clarity: No obligation for employees to reimburse recruitment agency commission!

Employers often use recruitment agencies to recruit staff. A contractual clause that obliges employees to repay the agency commission in the event of premature termination is invalid. Find out more about the details and the ruling of the Federal Labor Court here.

Read moreSkilled worker immigration 2024: This will also apply from June 01, 2024

The Skilled Immigration Act is intended to counteract the enormous shortage of skilled workers in Germany. Following the first stage in November 2023 and the second stage in March 2024, the third stage will now bring about changes to the immigration of skilled workers for the last time.

Read moreTaxes: Usufruct of a securities account reduces gift tax

When it comes to transferring assets to the next generation, there is always the issue of gift tax. If securities accounts are transferred by way of anticipated succession, a so-called usufructuary account reduces the gift tax for the person receiving the gift.

Read moreFoundation and association part 2: the charitable foundation

If you want to set up a non-profit organization (NPO), sooner or later you will have to think about the right legal form and organization. To found an NPO, you can use the common legal forms from company law (GbR, GmbH, etc.).

It is important to know here: Under certain conditions,

Read moreData protection is not crime protection! No prohibition of exploitation in the case of open video surveillance: A current labor law ruling clarifies!

Even if an employer’s surveillance measure was not carried out in full compliance with the requirements of data protection law, there is generally no prohibition on the use of recordings obtained from open video surveillance in a dismissal protection process. Find out more about the details and legal implications of this judgment in this article.

Read moreObligation to notify gifts and acquisitions by reason of death

Are you aware that there is a duty of disclosure for gifts and acquisitions by reason of death in accordance with Section 30 of the Inheritance Tax and Gift Tax Act (ErbStG)?

This duty of disclosure is an essential aspect of the tax treatment of inheritances and gifts and must be made within a certain period of time.

Read moreFoundation and association – Part 1: the non-profit association

Anyone thinking about getting involved in society – possibly together with others – must decide at some point what legal form this should take.

If you want to set up a non-profit organization (NPO), you can use the usual legal forms from company law (GbR, GmbH, etc.). However,

Read moreHow and when should real estate be transferred within the family?

Owning a home often plays a central role in the lives of many families. Whether for their own use or as an investment, their own four walls should also offer their descendants stability and security.

To ensure that this also works in reality, the issue of transferring a property should be addressed at an early stage.

Read moreSkilled Immigration Act 2024: 2nd stage since the beginning of March

Since November 2023, the first adjustments to the right of residence under the Skilled Immigration Act have taken effect. Since the beginning of March 2024, further regulations have been in place to facilitate the immigration of skilled workers in order to counteract the shortage of skilled workers.

In this article,

Read moreTax investigation targets online poker: When the game gets serious.

At the end of 2023, numerous online poker players who had carried out their activities on various platforms received mail from the tax investigation authorities. Some of these players were asked to complete a questionnaire regarding their poker activities. Others were immediately confronted with the opening of criminal proceedings on suspicion of tax evasion.

Read moreFair pay for all? The Pay Transparency Directive will change things for employers

The idea of equal pay for equal work or work of equal value – equal pay – is not new. And yet this demand has only really gained momentum in recent years. However, equal pay naturally requires transparency as to who receives what pay in what function. This is where the EU’s Pay Transparency Directive (EntgTranspRL) comes in.

Read moreFrom landlord to tax evader? These are pitfalls.

Landlords beware: How to avoid unintentional mistakes on your tax return!

This article will give you an insight into how landlords can unintentionally become tax evaders. As the tax regulations in the area of letting are very complex, misunderstandings can easily arise and even well-intentioned actions can lead to serious consequences such as criminal tax proceedings.

Read moreInherited a property in Italy – and now?!

Did your parents or grandparents once fulfill their dream of owning their own property in Italy? Whether it was a vacation apartment on Lake Garda or a house in Tuscany, it is possible that this property will be included in the estate.

But what do you do with the property then?

Read moreClaiming a compulsory portion – what you should know

Claiming the compulsory portion is often necessary after a disinheritance if heirs do not want to fulfill the compulsory portion claim or want to pay out too small a share of the value of the estate.

But who is entitled to the compulsory portion? Who can sue for the compulsory portion?

Read moreMaternity protection pay: no disadvantage with seasonally fluctuating income

When it comes to maternity protection pay and the amount of maternity protection pay under the Maternity Protection Act (MuSchG), the last three months before the start of a pregnancy are relevant for the calculation. This is not a problem for women with a fixed monthly income or a low proportion of variable remuneration.

Read morePseudo self-employment: When are “freelancers” employees after all?

Bogus self-employment is a recurring issue for companies that employ freelancers and for freelancers themselves. And yet both sides tend to bury their heads in the sand when it comes to this issue and hope that everything will work out. However, it would be better to address this problem proactively and find solutions.

Read moreContesting a will: What you need to know and bear in mind

Wills are always a cause of dispute and anger among relatives of a deceased person. And it is not uncommon for relatives to want to contest a will. The motives for contesting a will are then very different.

However, it is not always possible and/or sensible for a relative to contest a will.

Read moreTax evasion & voluntary disclosure – what you should know!

Many people associate the topic of tax evasion with celebrities who “end up” in prison for a certain period of time with a lot of hype in the tabloids. We remember, for example, soccer managers, ex-professional tennis players or star chefs who were tried for tax evasion, sentenced to prison and had to spend some time in jail.

Read moreTermination without notice due to chat comments: Current labor law ruling creates clarity!

Focus on the BAG ruling from August 24, 2023

In a recent employment law case, an employee was terminated without notice after insulting, racist, sexist and violence-glorifying remarks surfaced in a chat group with colleagues. The members of the group were long-time friends and colleagues, but the employer learned of the remarks and terminated the employee.

Read moreCriminal tax proceedings against crypto trader: tax office has first data available

The tax office has gained access to crypto trades – a wake-up call for all crypto traders.

- Is there now a threat of a wave of criminal tax proceedings against crypto traders?

- How do I react when the tax authorities inquire?

- What should I do if I am included on the record available to the tax office and the tax office writes to me?

Workation revolution: working abroad as an unbeatable benefit!

How to inspire top talents with flexible working models and keep legal and tax aspects in focus.

In today’s working world, flexibility is becoming increasingly important, both for employers and employees. One innovative option that has emerged in recent years is workation.

Workation combines work and leisure by allowing employees to work in an attractive location abroad.

Read moreBitcoin as a commodity: Will alternative coins be classified as securities in the US?

A new wind is blowing through the crypto world, as discussions are underway in the U.S. about whether Alternative Coins (Altcoins) should be classified as securities. This potential change raises questions:

- What does this mean for fun cryptocurrencies like Dogecoin and Shiba Inu? What about established giants like Bitcoin and Ethereum?

Whistleblower Protection Act & Protection against Dismissal: How the law protects whistleblowers

The Whistleblower Protection Act (HinSchG) is currently on everyone’s lips – after all, the legislator has managed to transpose the EU Whistleblower Directive into federal law: the Whistleblower Protection Act will come into force on July 2, 2023.

The main focus of discussion is the obligation, from a compliance point of view,

Read moreEmployment of full pensioners: what employers should know!

Employing full pensioners is a good way for employers to fill staffing gaps in times of a shortage of skilled workers and general staff shortages. In particular, the use of full pensioners is relatively uncomplicated for employers: in many respects it is no different from the use of non-pensioners, and in some cases there are even advantages.

Read moreImportant changes in foundation law as of July 2023

From July 1, 2023, the Act on the Unification of Foundation Law will come into force, bringing together, supplementing and clarifying many previously unclear, contradictory or incomplete points in foundation law. In addition to new, uniform federal regulations, the reform also includes the introduction of a central foundation register. The changes are intended to provide greater legal certainty in matters of liability,

Read moreTax-privileged fringe benefits: How companies can score points in the battle for satisfied employees

Everyone is talking about a shortage of skilled workers – but what can companies do to retain good employees in the long term? In addition to a good working atmosphere, performance-related pay is of course a very important factor. However, more than half of every euro of a salary increase often goes to taxes and social security contributions.

Read moreWorking time recording & trust-based working time: will it still work in the future?

At the end of 2022, the German Federal Labor Court (Bundesarbeitsgericht – BAG) issued a landmark ruling stating that recording working hours is no longer a “can” but a “must”. Employers must – even now! – record the working hours of their employees. For new-work models based on trust-based working time,

Read moreBitcoin & Co: BFH rules crypto profits are taxable! What do crypto investors need to know now?

With the decision of the Federal Fiscal Court (Bundesfinanzhof, BFH) of February 28, 2023, the highest German fiscal court has now for the first time taken a position on income tax issues relating to crypto assets – Bitcoins and Co.

In it, the previously issued fiscal court decisions are followed and also essential excerpts of the BMF letter of May 10,

Read moreChild benefit evaded? Criminal charges for tax evasion can be the consequence!

Under certain conditions, parents in Germany are entitled to child benefit. As of January 1, 2023, the entitlement to child benefit is a uniform 250 euros per month and child and is paid out to parents by the family benefits office. So far, so good.

But if the family benefits office pays out child benefits even though parents are not (or no longer) entitled to them,

Read moreReal estate valuation newly regulated – higher inheritance tax and gift tax for real estate since 01.01.2023

Real estate valuation in the event of a gift or inheritance has always been a bone of contention. Now, the legislator has reformed the Valuation Act – and with significant effects on the calculation of inheritance tax and gift tax in connection with real estate. This is because the value of real estate has been determined on the basis of the market value for the calculation of gift and inheritance tax since the changes to the law on 01.01.2009.

Read moreFederal Labor Court (BAG) ruling: Vacation is only time-barred after notice from the employer

Whether and when vacation becomes time-barred is a question that can of course also be of burning interest to employers: After all, whether their own employees are still entitled to vacation or not can become relevant above all if an employee leaves the company and in this context asserts claims for vacation compensation.

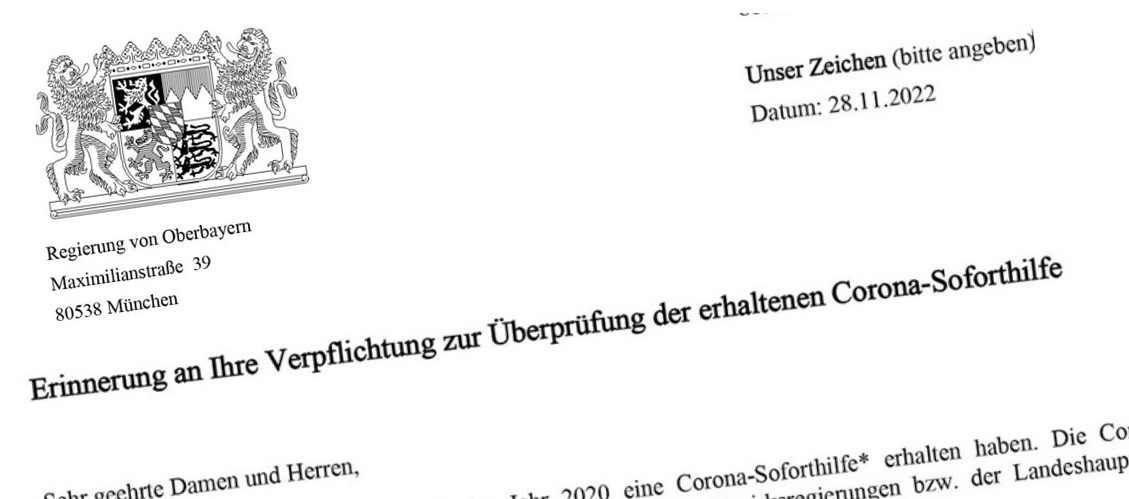

Read moreCorona emergency aid – who is facing repayment?

In the first months of the Corona crisis, the government granted emergency aid to smaller companies and solo self-employed persons who found themselves in an existential emergency. Eligibility to apply for Corona emergency aid was conditional on the existence of a short-term liquidity shortage. According to the approval notice, all recipients of emergency aid are obliged to check whether the predicted liquidity bottleneck has actually occurred.

Read moreInflation compensation premium: what employers need to know now!

The inflation compensation premium is currently the talk of the town. After all, it gives employees hope that they will receive a payment of up to 3,000 euros from their employer to compensate for the current rapid inflation – tax-free and free of social security contributions.

What is correct is that employers have the option of paying employees an inflation compensation bonus.

Read moreAll around the mini-job! Current labour law

From 01 October 2022, the statutory minimum wage will increase to EUR 12 per hour. At the same time, the remuneration for mini-jobs will be increased from EUR 450 to EUR 520 per month.

In connection with the mini-job, there are a number of things to consider from an employment law perspective.

Read moreBureaucratic monster for employers? Employment contracts must comply with stricter requirements as of 1 August

Evidence Act: Employment contracts must be put to the test with regard to mandatory transparent working conditions

From 1 August 2022, the amended regulations of the Verification Act will apply. The background to this is the EU Directive 2019/1152 (Working Conditions Directive), which comes into force on 31 July 2019.

Read moreInheriting debts: what you can do to prevent this from happening!

An inheritance – despite all the personal tragedy – is often a financial blessing for the heirs. Never before has so much wealth been inherited in Germany as at present. However, there is also the other case: the testator or the testatrix – e.g. one’s own parents or spouse –

Read moreThe GbR company register is coming: clarify now what needs to be done!

Information about a GbR and the persons behind the GbR has not been as easy to obtain as, for example, in the case of a GmbH.

This will change on 01.01.2024 when the Act to Modernise the Law on Partnerships (MoPeG) introduces the company register for civil law companies.

Read moreCurrent BAG ruling on overtime: Burden of proof not on the employer!

Overtime and its compensation are often the cause of disputes between employees and employers. This is especially true when overtime is still “on the books” after a dismissal and ex-employees want to be paid for this overtime.

But who has to prove whether overtime was actually worked? So far,

Read moreSecretly recording a conversation at the workplace: Can employees be dismissed (without notice)?

Discussions between employers or supervisors and employees are often delicate. If conflicts are smouldering or have already erupted in the working relationship, they can become very verbal.

It is not uncommon for employees to reach for their smartphones and secretly record conversations with their employers or superiors that are supposed to be confidential.

Read moreLabour law: current case studies and judgments

Read the background and rulings on exciting issues that concern employees and employers alike:

- What happens to already granted leave during a quarantine order?

- Dismissal without notice even in the case of embezzlement of low-value amounts?

- Dismissal without notice for reading and passing on someone else’s e-mail?

Transparency register & GmbH: Entry until 30.06. – fine threatens

GmbHs and UGs must correctly enter beneficial owners in the transparency register by June 30, 2022. Otherwise, those responsible will face heavy fines.

Read more about the transparency register and the registration deadline.

Read moreCrypto, NFT, virtual currencies and other tokens: what does the current BMF letter say?

The new BMF letter “Einzelfragen zur ertragsteuerrechtlichen Behandlung von virtuellen Währungen und von sonstigen Token” has meanwhile also been published. Below you will find my brief and initial assessment of the letter of the Federal Ministry of Finance (BMF).

Our expert Dr.

Read moreIncome tax return 2021: How do I take my crypto investments into account?

With an estimated 5,000,000 people in Germany investing in the crypto world, many will soon be asking the question, “How do I account for my crypto investments in my 2021 income tax return?” Some individuals will have to make sometimes substantial tax payments as a result of their crypto investments and will thus also be required to file an income tax return in due time.

Read moreFacility-based mandatory vaccination against Corona: authorities get serious!

Since March 16, 2022, the facility-based vaccination obligation has been in effect: employers must report to the health department all employees* – including all external service providers in the company (!) – who have not been vaccinated against the Corona virus, have not recovered, or have not been vaccinated for medical reasons.

Read moreFacility-based mandatory vaccination: individual consultation hours for your employees

Compulsory vaccination for healthcare workers is currently the talk of the town and the subject of heated debate. In fact, there are still employees who do not want to be vaccinated against the coronavirus – even in health-sensitive professions. Whether employers understand this or not is a moot point.

Read moreEmployees in quarantine: who pays?

With the current Omikron wave, the Corona pandemic is leading to infection figures in unprecedented numbers. At the same time, this is leading to an unprecedented number of employees having to go into quarantine on the instructions of the health authorities and on the basis of the Infection Protection Act (IfSG).

Read moreReminder! Expiry of the transitional periods for entry in the transparency register

Have you already notified the beneficial owners of your legal entity to the Transparency Register? Not yet? Then it is high time you did!

With the amendments to the Money Laundering Act (Transparency Register and Financial Information Act) that came into force on 1 August 2021,

Read moreCorona lawsuits and recent rulings on them – an update

As early as summer 2021, we compiled interesting labour law cases and rulings on Corona measures for you up to that point. The courts have since made further important rulings – on the following questions:

- Does an employer have to compensate his employees in the event of an officially ordered plant closure?

Are profits from cryptocurrency trading subject to tax? Revision BFH withdrawn

The BFH (Case No. IX R 27/21), Germany’s highest tax court, was supposed to deal with this question; a decision was expected in February. This has now come to nothing. The appeal filed by the taxpayer has been withdrawn in the meantime.

With increasing crypto trading,

Read more