With an estimated 5,000,000 people in Germany investing in the crypto world, many will soon be asking the question, “How do I account for my crypto investments in my 2021 income tax return?” Some individuals will have to make sometimes substantial tax payments as a result of their crypto investments and will thus also be required to file an income tax return in due time.

Our expert Dr. Christopher Arendt answers important questions about this. Read the interview with him.

Income tax return 2021: crypto investments

Dr. Arendt, many people are now about to file their tax returns for the year 2021.

Some people bought cryptocurrencies for the first time last year and may not know exactly what they have to consider and declare in their tax return. Would you please answer a few questions below?

Yes, with pleasure. I am eager to hear your questions.

If you bought Bitcoin, Ethereum, Solana or other crypto coins in 2021 and still hold them unchanged, do you even have to disclose that to the IRS?

Contrary to what the name suggests, “cryptocurrencies” are not a means of payment according to the current income tax classification. Rather, Bitcoin and comparable coins represent digital units of value. They are treated as other assets for tax purposes. For tax purposes, they are treated in the same way as art objects, vintage cars and gold, for example, and are classified as private sales transactions.

The mere acquisition and holding of cryptocurrencies does not have to be reported to the tax office and usually does not trigger any taxes.

What to consider if you have made several transactions or possibly conversions to other cryptocurrencies during the year? Does all this need to be documented and reported or only when sales are made and profits realized?

A good and ideally ongoing self-documentation of the individual transactions is important to keep an overview. I myself have struggled through the “reports” of the various providers and have noticed how time-consuming this is.

The assumption that a profit is only realized when the coin is exchanged from the “crypto world” back into the fiat currency (such as EUR or USD) is unfortunately a misconception from a tax perspective.

If I exchange one coin for another or pay with a coin in order to purchase an NFT, for example, this is an exchange within the crypto world for tax purposes (coin for NFT). However, this is to be treated for tax purposes like a sale of the Coin and can be tax-relevant.

The consequence is that a capital gain arises upon surrender, since it is irrelevant whether I receive money or a new asset for a coin. In short, even though two virtual currencies are exchanged, new acquisition costs are incurred for the new asset and, if applicable, a taxable capital gain is generated for the given coin.

What is the best way to document these processes so that they meet the requirements of the tax office? Do you have any recommendations on what needs to be documented and which format or app is suitable for this?

The documentation effort can become very costly. Especially if you acquire other tokens like NFT’s with individual crypto coins, the complexity increases significantly.

On the one hand, the acquisition transactions of the coins have to be documented and converted into EUR, on the other hand, the acquisition transactions of the tokens acquired with the coins have to be documented and assigned to the coins. I have made my own Excel table for this purpose. The existing providers often have the problem that they work with USD or that not all transactions are documented according to German tax law and its particularities. An own contribution remains (unfortunately) still necessary with the apps known to me. However, I do not claim to know all providers.

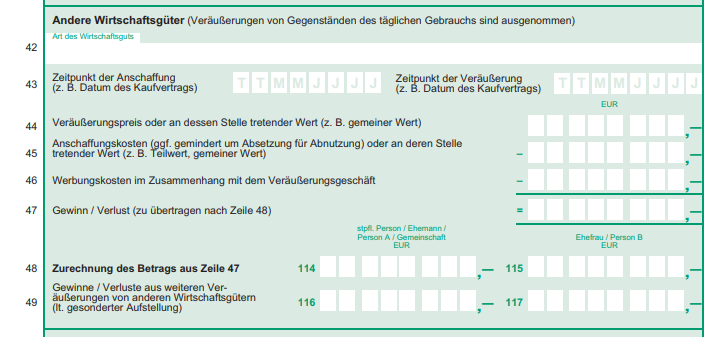

What happens when I have realized profits? How are these to be taxed in concrete terms, how does taxation work in detail? Where do I indicate this or where exactly is this to be noted in the forms?

I would like to describe this with the following (simple) example:

Franz acquires Bitcoin worth EUR 1,000 for the first time on 04/01/2021.

On 12/12/2021, Franz sells his entire holding of Bitcoins for EUR 1,500. For the sale transaction Franz has to pay € 10 transaction costs.

Since Franz acquired and sold Bitcoins within one year, the transaction is within the speculation year.

Franz determines his profit as follows:

Determination of profit:

1,500 € Sales price (line 44 of the form below)

– 1,000 € acquisition cost (line 45 of the form below)

– 10 € transaction costs (line 46 of the form below)

= 490 € gain on sale to be recognized (line 47 of the form below)

Gains from the sale of cryptocurrencies remain tax-free if the total profit generated from all tax-relevant private sales transactions in the relevant calendar year is less than €600 (cf. Section 23 (3) sentence 5 EStG). This is an exemption limit and not an allowance. This means that the person who achieves a total profit higher than € 601 has to pay tax on the entire profit.

If the capital gain were now EUR 10,000, Franz would be obliged to declare this in his income tax return: He would then be taxed at his personal income tax rate, which is regularly higher than the rate we know from stock gains, for example.

What can happen if I “forget” and do not provide this information? Do I then automatically make myself liable to prosecution?

If you forget taxable income in your income tax return, this is fundamentally problematic and in the worst case can also have relevance under criminal tax law.

This danger should by no means be underestimated, which is why all potentially affected taxpayers are strongly advised to make the effort to work through the individual transactions. This is the only way to get an overview of whether a potential tax burden exists and how high it is.

In criminal tax law, it is generally not advisable to retreat to the position of one’s own ignorance in tax matters to justify one’s tax inactivity.

With which frequently occurring questions do clients turn to you? What specific advice can you give?

In the consulting sessions, a lot of fundamental tax issues are discussed. Unfortunately, the uncertain legal situation in connection with “cryptocurrencies” is still problematic. In the interview, I only addressed the basic constellation. This has also already been the subject of proceedings before the Tax Court. However, the crypto world is very diverse – which has a direct influence on the tax treatment.

If you look at the mergers of investors in DAOs or at the various similarly organized NFT projects, it is not always possible to provide binding tax information, even for us consultants. This is due to the Federal Ministry of Finance, which unfortunately has not yet taken a conclusive position on many tax issues. At the same time, however, taxpayers are running out of time to file their 2021 tax returns.

It is precisely against this background that good documentation of all the transactions carried out is essential.

Are there any special tips from your past experiences that you would like to share with us?

Many individuals unfortunately underestimate the tax magnitude of the transactions made in the crypto world. For many, the feeling of tax irrelevance prevails as long as everything remains in the crypto world.

However, the following applies: Each transaction can trigger a taxable event individually and by itself. If the generated crypto assets are reinvested further and further, one must bear in mind that this is untaxed money.

Since income tax is an annual tax, this carries a high and unrecognized tax risk, because what happens if the rates crash in subsequent years. Then the investors are left with the tax liability from previous profits, which they may no longer be able to pay due to the lack of liquidity. Therefore, one should think carefully about the amount in which one reinvests profits that have arisen in the meantime.

Thank you very much for the interview.

CRYPTOCURRENCY TRADING

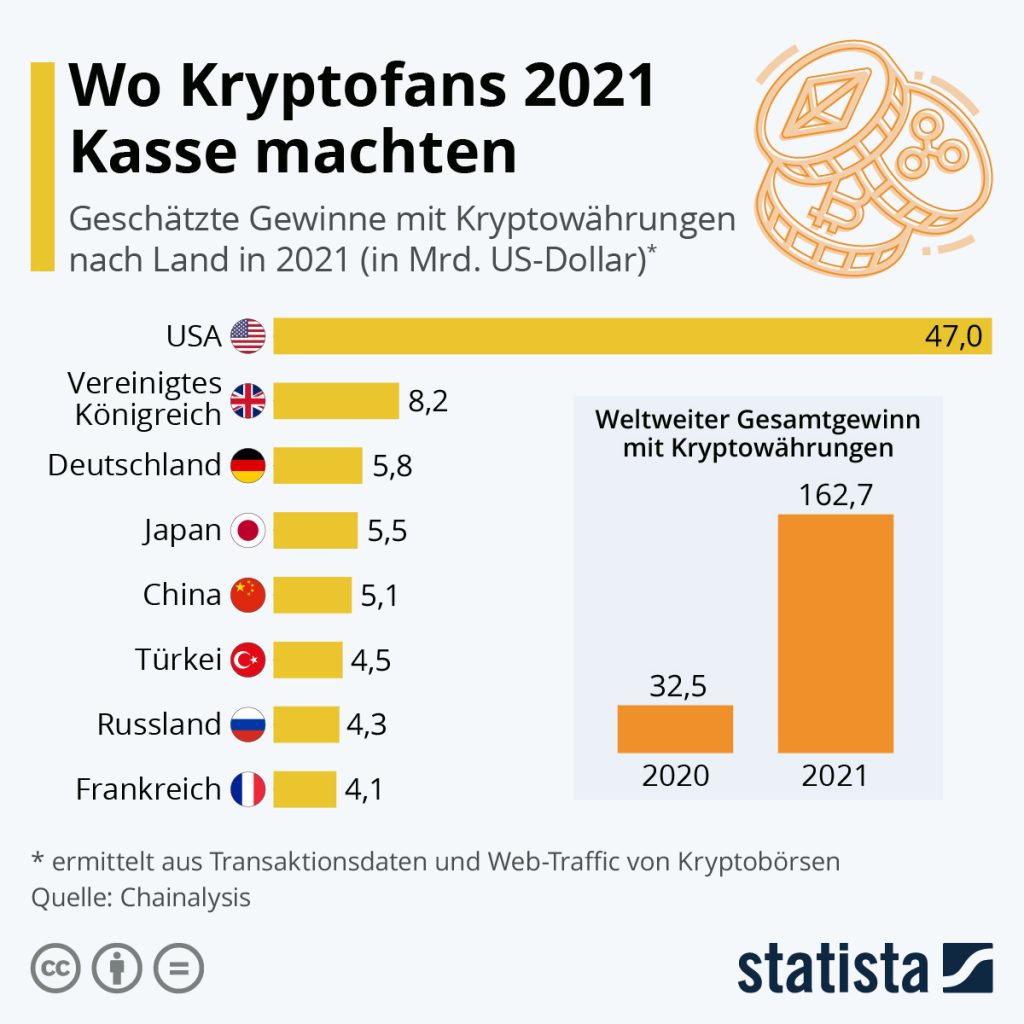

Where crypto fans cashed in 2021

by Florian Zandt, 22.04.2022

This chart shows the estimated profits with cryptocurrencies by country.

Source: statista

https://de.statista.com/infografik/27284/geschaetzte-gewinne-mit-kryptowaehrungen-nach-land/

Questions on crypto trading and taxation?

Lawyer

Specialist lawyer for tax law

Managing Director of ACCONSIS

Dr. Christopher Arendt

Service-Phone

+ 49 89 547143

or by e-mail c.arendt@acconsis.de

My recommendation?

The tax aspect behind crypto trading with cryptocurrencies or crypto art also harbours many dangers and challenges. I would be happy to advise you individually on this and work with you to find solutions to safeguard your digital returns.

If you have any questions on this topic, please do not hesitate to contact me.

ACCONSIS in the press:

€uro am Sonntag, Wie der Fiskus auf Gewinne aus Kryptowährungen zugreifen darf, ist für viele Investments noch nicht klar geregelt. Auf welche Fallstricke Anleger achten sollten, 27.02.2022

Börse-Online, Krypto-Investments bei Teenagern: “Gefahr von Steuerstraftaten”, 17.02.2022

BR24, Krypto-Investoren im Steuerdschungel, 04.02.2022