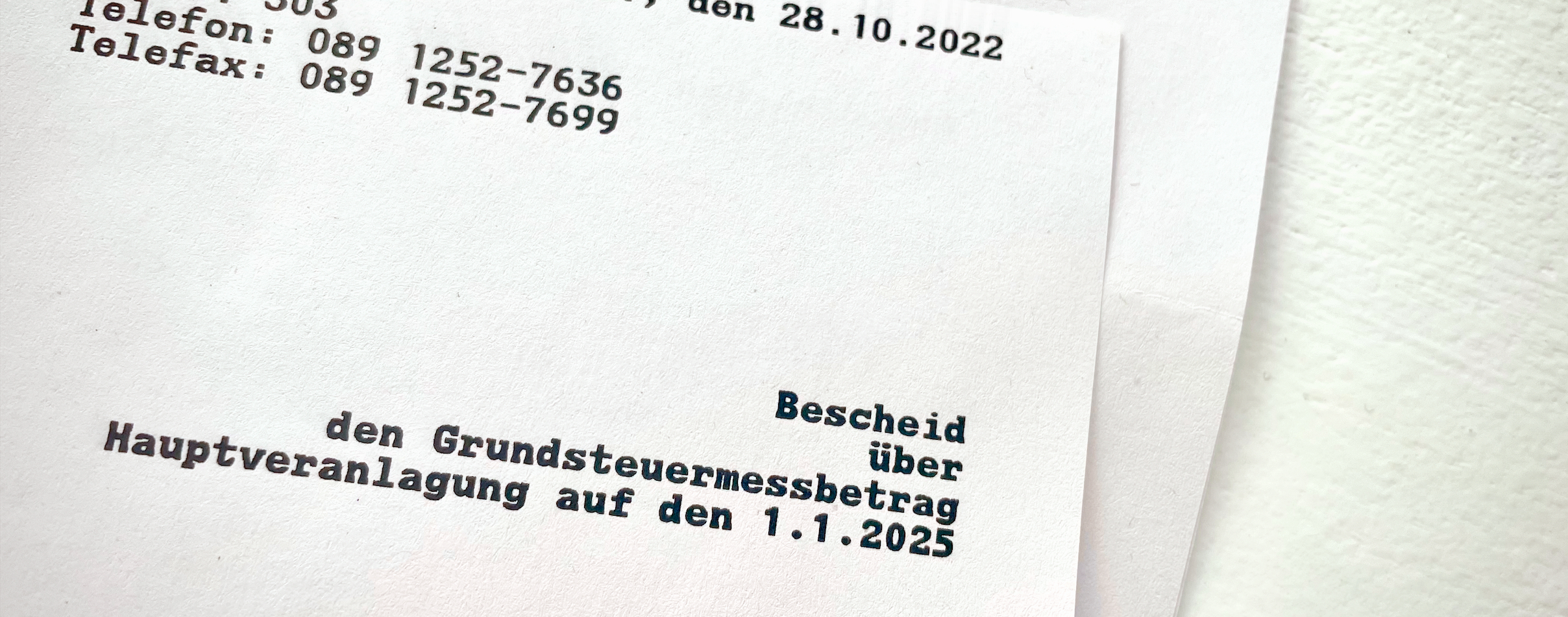

In connection with the property tax reform, many property owners receive the property tax assessment notices from the tax office.

In Bavaria, in addition to the “notice of the property tax assessment amount”, a “notice of the property tax equivalent amounts” is also issued. In other federal states, the assessment procedure differs somewhat in some cases.

Now that we have received many questions as to whether the property tax assessment amount on the notice of the new property tax is to be paid monthly, quarterly or annually, we would like to set the record straight and have therefore summarized the most important points for you.

Notices on the property tax assessment amount: What should be checked and observed?

The determinations made in the “notice on the property tax assessment amount” and the “notice on the property tax equivalent amounts” form the assessment basis for the new property tax levied from 01.01.2025. The basis for this is the property tax return submitted and (for properties in Bavaria) the Bavarian Property Tax Act.

Here you should check whether the listed areas, equivalent amounts and owners have been correctly taken into account.

What do I have to do if the notices are wrong and what is the deadline for appealing?

If there are any objections to the findings or if data has not been recorded correctly, you should file an appeal against the respective incorrect notice with the responsible tax office (see sender of the notices) within one month of the notice being issued.

In addition to the file number (see top left of the notice), the written letter of objection must state the reasons why the determination is incorrect. If the one-month objection period is culpably missed, the notices are legally binding and an amendment is only possible under special circumstances.

How long are the notices valid?

In Bavaria, there is no provision for regular (automatic) updating of the property tax assessment amount. Only in the case of relevant changes described in the law (e.g. structural changes) is there an update of the originally determined values. In this context, the applicable notification requirements for changes must be taken into account.

Do I have to make a payment and for what period does the property tax assessment apply?

The property tax assessment notice is a basic notice that determines the assessment basis for the new property tax from 01.01.2025, which in turn is levied by the respective municipality.

However, the property tax assessment notice does not yet give rise to an obligation to pay.

The assessed property tax amount is forwarded to the relevant municipality. There, the property tax will be determined by means of the individual assessment rates and will be set in a further property tax assessment notice of the municipality and communicated to you.

This is the basis for the actual property tax to be paid and the obligation to pay.

The assessment rates of the municipalities for the levy from 01.01.2025 have not yet been published.

.

We support you!

If you have any questions about your property tax assessment notice or need further information, please feel free to contact me.

From the preparation of the assessment declaration to the assessment review: I will of course support you in this process.

Please feel free to contact us.

Your ACCONSIS contact

Andreas Jovanic

Steuerberater

Service-Telephon

+49 89 547143

or by e-mail