Everyone is talking about a shortage of skilled workers – but what can companies do to retain good employees in the long term? In addition to a good working atmosphere, performance-related pay is of course a very important factor. However, more than half of every euro of a salary increase often goes to taxes and social security contributions.

Another option: offer your employees tax-privileged or even tax-free salary components.

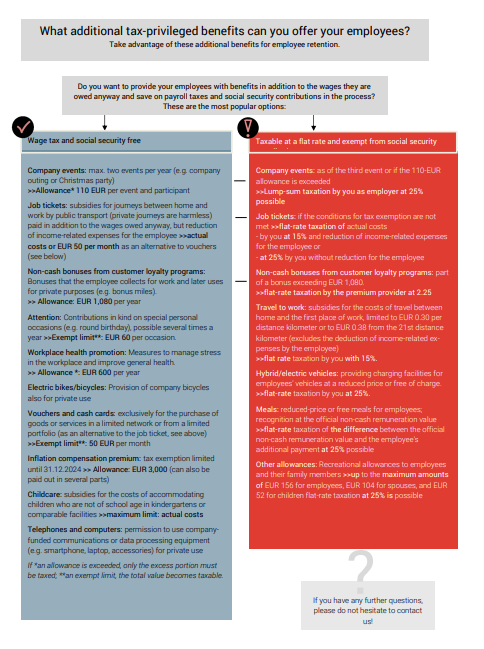

Which additional benefits are eligible? A clear infographic (Free download!) shows the most popular additional benefits as well as their tax advantages and allowances or limits that need to be taken into account.

Tax-privileged fringe benefits – a win-win situation

Employers have the advantage that tax-privileged or tax-free benefits do not incur social security contributions, half of which would otherwise have to be paid by the employer. And employees benefit from a higher net salary. A win-win situation, in other words.

What additional benefits are available?

The range is wide: from invitations to company events and health promotion measures to job tickets and childcare subsidies.

But not every fringe benefit is suitable for every employee. It is therefore important to find the right benefit. For employers, it is also interesting to distinguish between tax-free and lump-sum taxable benefits.

To help companies make the right choice, we have created an infographic that provides an overview of the most popular tax-privileged fringe benefits for employees. The current tax-free amounts or exemption or maximum limits are clearly noted for each benefit.

Download this infographic free of charge and let it inspire you. Especially in times of a shortage of skilled workers, it is important to be an attractive employer and to retain good employees in the long term.

Attractive tax-privileged fringe benefits – an overview

For free download you will find an overview of the most popular options of

- Fringe benefits that are exempt from income tax and social security contributions

- Fringe benefits that are taxable at a flat rate and exempt from social insurance.

We will be happy to send you the document by e-mail:

Do you have any questions?

Pia Lösch

Head of Wage and Salary Department

Service Phone

+ 49 89 547143

or by E-mail:

p.loesch@acconsis.de