Bogus self-employment is a recurring issue for companies that employ freelancers and for freelancers themselves. And yet both sides tend to bury their heads in the sand when it comes to this issue and hope that everything will work out. However, it would be better to address this problem proactively and find solutions.

Continue ReadingCategory: Topic of the month

Tax-free kindergarten allowance for employees

Employers have the option of paying their employees tax-free allowances in addition to their salary for the care of their non-school-age children in kindergartens or similar facilities.

Read the following article to find out which facilities are eligible and which regulations and requirements apply.

Continue ReadingTermination without notice due to chat comments: Current labor law ruling creates clarity!

Focus on the BAG ruling from August 24, 2023

In a recent employment law case, an employee was terminated without notice after insulting, racist, sexist and violence-glorifying remarks surfaced in a chat group with colleagues. The members of the group were long-time friends and colleagues, but the employer learned of the remarks and terminated the employee.

Continue ReadingTax calculation of partial monthly amounts

An employee of your company starts or ends his employment during the current month? If so, this has wage tax implications that need to be taken into account.

In the following article, you will learn when exactly a partial wage payment period arises and what must be taken into account for wage tax purposes.

Continue ReadingWorkation revolution: working abroad as an unbeatable benefit!

How to inspire top talents with flexible working models and keep legal and tax aspects in focus.

In today’s working world, flexibility is becoming increasingly important, both for employers and employees. One innovative option that has emerged in recent years is workation.

Workation combines work and leisure by allowing employees to work in an attractive location abroad.

Continue ReadingFlat-rate payroll tax according to §37b EStG for benefits in kind

The lump-sum wage taxation according to §37b EStG offers employers the possibility to tax certain benefits in kind to employees with a uniform tax rate of 30%.

There is a choice between taxing the benefits in kind at the employee’s individual tax rate or lump-sum taxation, in which the employer bears the amount of payroll tax alone.

Continue ReadingWhistleblower Protection Act & Protection against Dismissal: How the law protects whistleblowers

The Whistleblower Protection Act (HinSchG) is currently on everyone’s lips – after all, the legislator has managed to transpose the EU Whistleblower Directive into federal law: the Whistleblower Protection Act will come into force on July 2, 2023.

The main focus of discussion is the obligation, from a compliance point of view,

Continue ReadingEmployment of full pensioners: what employers should know!

Employing full pensioners is a good way for employers to fill staffing gaps in times of a shortage of skilled workers and general staff shortages. In particular, the use of full pensioners is relatively uncomplicated for employers: in many respects it is no different from the use of non-pensioners, and in some cases there are even advantages.

Continue ReadingTax-privileged fringe benefits: How companies can score points in the battle for satisfied employees

Everyone is talking about a shortage of skilled workers – but what can companies do to retain good employees in the long term? In addition to a good working atmosphere, performance-related pay is of course a very important factor. However, more than half of every euro of a salary increase often goes to taxes and social security contributions.

Continue ReadingWorking time recording & trust-based working time: will it still work in the future?

At the end of 2022, the German Federal Labor Court (Bundesarbeitsgericht – BAG) issued a landmark ruling stating that recording working hours is no longer a “can” but a “must”. Employers must – even now! – record the working hours of their employees. For new-work models based on trust-based working time,

Continue ReadingPayroll accounting 2023 – important innovations at a glance

In 2023, there are once again a number of adjustments to be made in the area of wage tax and social security law. Overview of relevant changes for employers:

- Higher earnings threshold for midijobs, minimum wage will remain

- Higher basic tax-free amount for wage tax

- Artists’

Federal Labor Court (BAG) ruling: Vacation is only time-barred after notice from the employer

Whether and when vacation becomes time-barred is a question that can of course also be of burning interest to employers: After all, whether their own employees are still entitled to vacation or not can become relevant above all if an employee leaves the company and in this context asserts claims for vacation compensation.

Continue ReadingInnovations in 2023 for sick leave and social insurance

Important changes will come into effect for employers and employees in 2023:

The paper sick bill – the famous “yellow bill” – will be abolished for those with statutory health insurance and replaced by an electronic certificate of incapacity to work. For employers, participation in the digital process will be mandatory from 2023.

Continue ReadingInflation compensation premium: what employers need to know now!

The inflation compensation premium is currently the talk of the town. After all, it gives employees hope that they will receive a payment of up to 3,000 euros from their employer to compensate for the current rapid inflation – tax-free and free of social security contributions.

What is correct is that employers have the option of paying employees an inflation compensation bonus.

Continue ReadingSocial security audit and external wage tax audit – what to watch out for in the future?

As part of the irregularly scheduled external wage tax audit, checks are made to see whether employers are properly paying wage tax for their employees. During the social security audit, the German Pension Insurance checks every four years, among other things, whether social security contributions have been correctly paid.

Our experience shows: The auditors are looking ever more closely and demanding more information or evidence.

Continue ReadingAll around the mini-job! Current labour law

From 01 October 2022, the statutory minimum wage will increase to EUR 12 per hour. At the same time, the remuneration for mini-jobs will be increased from EUR 450 to EUR 520 per month.

In connection with the mini-job, there are a number of things to consider from an employment law perspective.

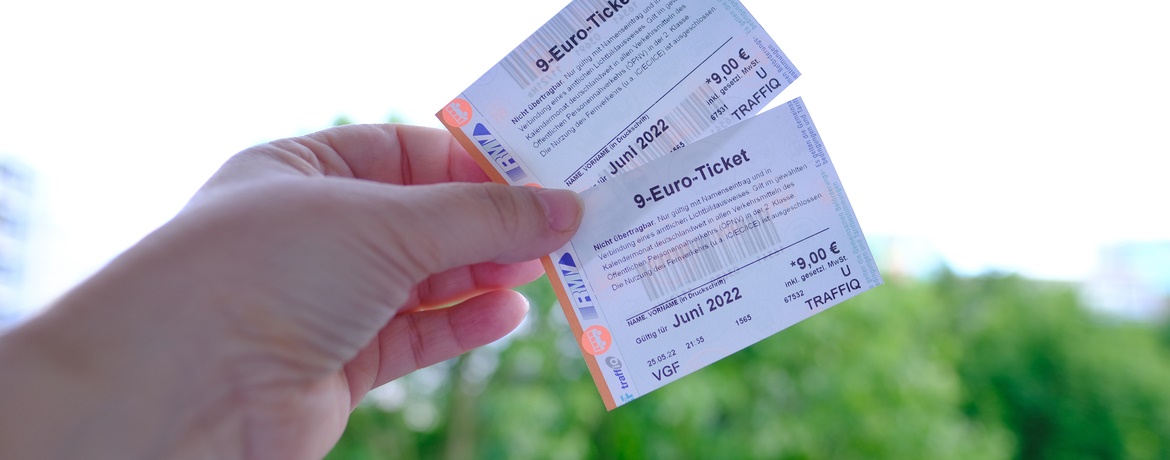

Continue Reading9-Euro Ticket and Energy Flat Rate from a Wage Tax Perspective

Due to rising energy prices, the German government has introduced tax relief measures. These include the 9-euro ticket and the flat-rate energy allowance.

From a payroll tax perspective, there are a few important points for employers to bear in mind.

Continue ReadingLabour law: current case studies and judgments

Read the background and rulings on exciting issues that concern employees and employers alike:

- What happens to already granted leave during a quarantine order?

- Dismissal without notice even in the case of embezzlement of low-value amounts?

- Dismissal without notice for reading and passing on someone else’s e-mail?

Transparency register & GmbH: Entry until 30.06. – fine threatens

GmbHs and UGs must correctly enter beneficial owners in the transparency register by June 30, 2022. Otherwise, those responsible will face heavy fines.

Read more about the transparency register and the registration deadline.

Continue ReadingEmployment of working students – what to bear in mind

For employers as well as for students, a working student contract is an interesting thing. Employers have fewer ancillary wage costs, and students have more net left over from the gross of their salary.

To do everything right from a tax perspective, employers need to pay attention to some important issues.

Continue ReadingTax-free benefits in kind – increase of the exemption limit

Since January 01, 2022, the limit for tax-free benefits in kind has been raised from 44 EUR to 50 EUR per month.

The 30% flat-rate tax is not applied if the employer provides non-cash benefits to employees that do not qualify as non-cash benefits subject to payroll tax.

Continue ReadingPayroll 2022 – important changes

The new year brings a number of changes in wage tax and social security law. What do you have to bear in mind in 2022? We have summarised the relevant changes for you.

- Increase in the minimum wage

- Minimum remuneration for apprentices

- Employer subsidy for deferred compensation

- Reporting of tax identification number for marginally employed

- Insurance status of short-term employees

- Electronic certificate of incapacity for work

- Tax-free remuneration in kind

Mini-jobs – what do you have to bear in mind when employing mini-jobbers?

Hiring mini-jobbers is an interesting way for employers to cushion peak workloads, especially in times of fluctuating orders. Of course, some important organisational and verification obligations must also be observed for marginally employed workers.

Important change in 2022: Notification of the tax identification number and statutory health insurance

From January 2022,

Continue ReadingCurrent case law on the certificate of incapacity for work

The Federal Labor Court recently had to rule on a case in which an employee gave notice of termination and submitted a certificate of incapacity for work to the employer on the same day as the notice of termination was received.

According to this certificate of incapacity for work,

Continue ReadingFlood disaster: How can employers provide assistance to affected employees?

Many employers would like to provide financial assistance to their employees who have been affected by environmental catastrophes. The following payroll tax simplifications apply to support affected individuals:

Affected employees can receive up to EUR 600 per calendar year tax-free from their employer as aid and assistance. If the aid is paid out to affected employees due to an extraordinary emergency situation,

Continue ReadingSalary extras – What benefits can I pay my employees in addition to their salary?

Particularly with regard to personnel recruitment, employers can offer additional, attractive benefits that go beyond mere payment in the form of salary.

With selected salary extras, employees’ pay can be optimized through tax-privileged and social security-free benefits to achieve a higher net payout. Employers can thus reward employees for good work performance,

Continue ReadingWe say goodbye to Board Member Wolfgang Stamnitz.

On Sunday, April 18, 2021, Wolfgang Stamnitz, co-founder and Chairman of the Board of ACCONSIS, passed away suddenly and unexpectedly.

As an entrepreneurial personality, he played a significant role in the success and continuous growth that has characterized ACCONSIS and its Munich-based predecessor company for 60 years.

Continue ReadingCompany bicycle for private use – what taxation rules apply?

Every employer can provide its employees with a company bicycle for private use free of charge or at a reduced price. The resulting benefit in money’s worth is then part of the taxable wages.

So-called pedelecs are operated with a max. 250 watt motor and are limited to a speed of 25 km/h.

Continue ReadingDismissal protection proceedings: Does the employee have a duty to provide information regarding job offers?

A lawsuit by an employee against the employer to protect against dismissal is always accompanied by a high cost risk for the employer.

If it turns out at the end of the often lengthy proceedings that the termination was invalid, the employment relationship is not terminated. But what is much more serious is that the employer must pay the contractually owed remuneration,

Continue ReadingWhat are the changes in 2021?

The new year brings with it a number of changes in payroll tax and social security law. We have summarized the most relevant changes in 2021 for you here. Here are the most important facts and key data:

- Increase in the general minimum wage

- Elimination of solidarity surcharge

- Electromobility: increase in monthly flat rates for charging

- Increase of the distance allowance

- Mobility bonus as an alternative to the distance allowance

- Increase in relief amount for single parents

- Contribution rates and levy rates in 2021

Quarantine, who pays the salary?

The second wave is just rolling in – there is currently no improvement in sight. In this context the questions arise,

- whether the employer must continue to pay the remuneration during a quarantine

- whether he/she may be entitled to a refund or

- whether he also has to pay if the employee returns from a risk area.

No short-time work compensation without German company headquarters?

Recently, there has been an increasing number of inquiries from concerned clients who employ employees in Germany subject to social security contributions but do not have a registered office in Germany.

This is usually due to notifications from the German Employment Agency which, referring to the lack of a company seat in Germany,

Continue ReadingWhat changes in short-time work and short-time allowance?

We have summarized all the changes in short-time working and short-time allowance for you. This applies in detail:

- the increase in the short-time working allowance

- the new rules for new mini-jobs during short-time work in the main job

- a summary of the recording obligation for marginally employed and short-term workers

You can find all details here.

Continue ReadingIs a reduction of holiday entitlement permitted during short-time work?

The “Covid-19” crisis is constantly presenting employees and employers with new challenges. One of the major current issues is the relationship between short-time work and holidays.

In order to avoid the loss of working hours, the remaining leave from the previous year must first be brought in. Now the question arises,

Continue ReadingTravel costs 2020 – what should be considered?

After the restrictions of the last few weeks, many companies are starting their everyday life again. Business trips are still a big part of many employees’ daily work. We have compiled a brief overview of what exactly has to be taken into account when it comes to travel costs, food expenses,

Continue Reading